Mutf_In: Hdfc_Midc_Oppo_Up4ui9

The HDFC MIDCap Opportunities Fund is designed to capitalize on mid-cap stocks with considerable growth prospects. Its investment strategy emphasizes rigorous research and a diversified portfolio to mitigate risks associated with market volatility. Performance analysis shows a mix of resilience and potential fluctuations, which raises important considerations for investors. Understanding these dynamics is crucial to making informed decisions about this fund’s alignment with individual financial objectives. What factors should investors weigh before committing their capital?

Overview of HDFC MIDCap Opportunities Fund

The HDFC MIDCap Opportunities Fund, an open-ended equity scheme, primarily focuses on investing in mid-cap stocks, which are often characterized by their potential for substantial growth.

The fund’s objectives center on capital appreciation through a diversified portfolio, while its investment strategy emphasizes rigorous research to identify promising mid-cap companies.

This approach aims to harness the growth potential, aligning with investor aspirations for financial independence.

Performance Analysis and Historical Returns

Performance metrics of the HDFC MIDCap Opportunities Fund reveal a significant track record in navigating the mid-cap segment of the equity market.

Historical returns indicate resilience amid market volatility, aligning with evolving investment trends.

The fund’s strategic positioning has allowed it to capitalize on growth opportunities, thereby offering investors a balanced approach to harnessing potential gains while managing inherent market fluctuations effectively.

Risk Factors and Considerations

What inherent risks should investors consider when evaluating the HDFC MIDCap Opportunities Fund?

Primarily, market volatility can significantly impact mid-cap stocks, leading to unpredictable performance.

Investors must also consider their investment horizon, as shorter timeframes may not accommodate the inherent fluctuations associated with this sector.

A thorough understanding of these risks is essential for making informed decisions aligned with individual financial goals and risk tolerance.

Strategic Insights for Investors

While navigating the complexities of mid-cap investments, strategic insights become crucial for investors considering the HDFC MIDCap Opportunities Fund.

Analyzing market trends reveals sectors poised for growth, while tailored investment strategies can optimize returns.

Investors should focus on diversification and monitor economic indicators, ensuring adaptability in a dynamic landscape.

Such informed approaches can enhance portfolio resilience and capitalize on emerging opportunities in mid-cap equities.

Conclusion

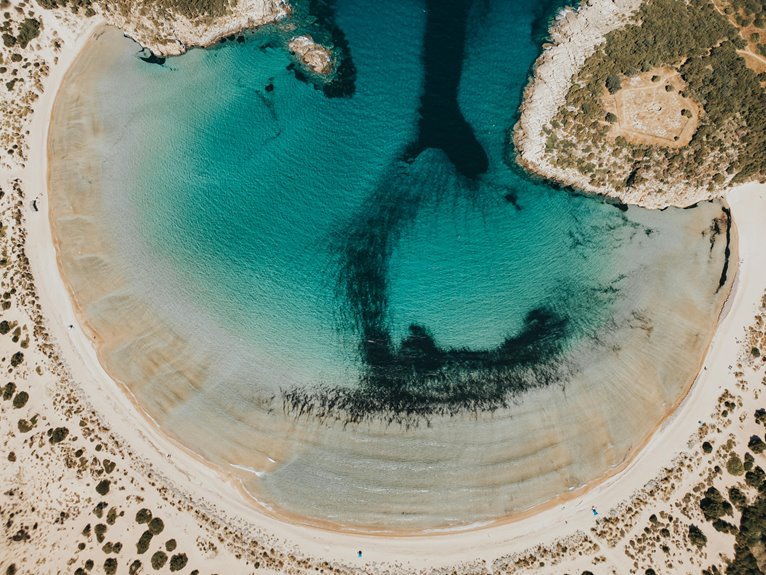

In the vast ocean of investment opportunities, the HDFC MIDCap Opportunities Fund emerges as a leviathan, promising unparalleled growth potential for the discerning investor. However, lurking beneath the surface are the unpredictable waves of market volatility, which can capsize even the most buoyant portfolios. Thus, while its historical returns may dazzle like glittering treasure, investors must wield strategic foresight and unwavering discipline to navigate these turbulent waters, ensuring their journey toward capital appreciation remains steadfast and rewarding.